Train Better Stock Decisions

Rule No.1 – Never Lose Money

Stockgaroo turns complex stock data into clear, repeatable decisions — helping investors judge with confidence, not guesswork.

How Stockgaroo Works

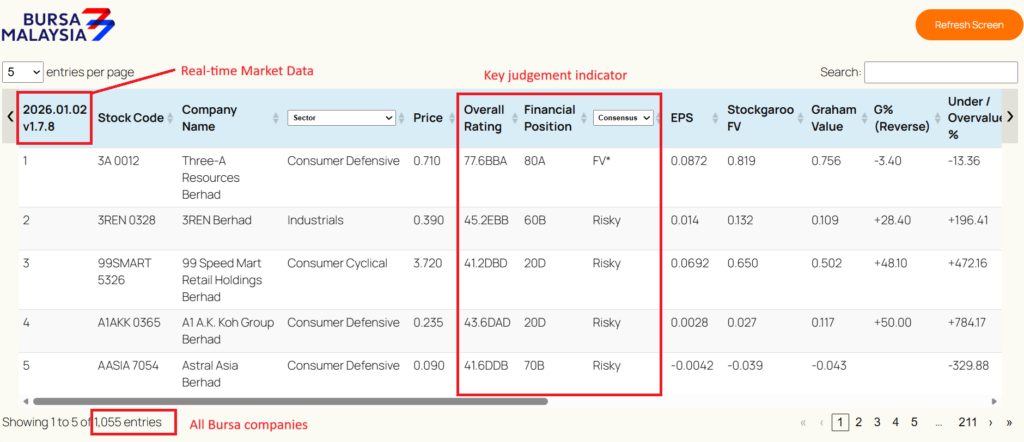

Stock Screener

Try me! ⬇️

Judgement

Good judgement, never lose money!

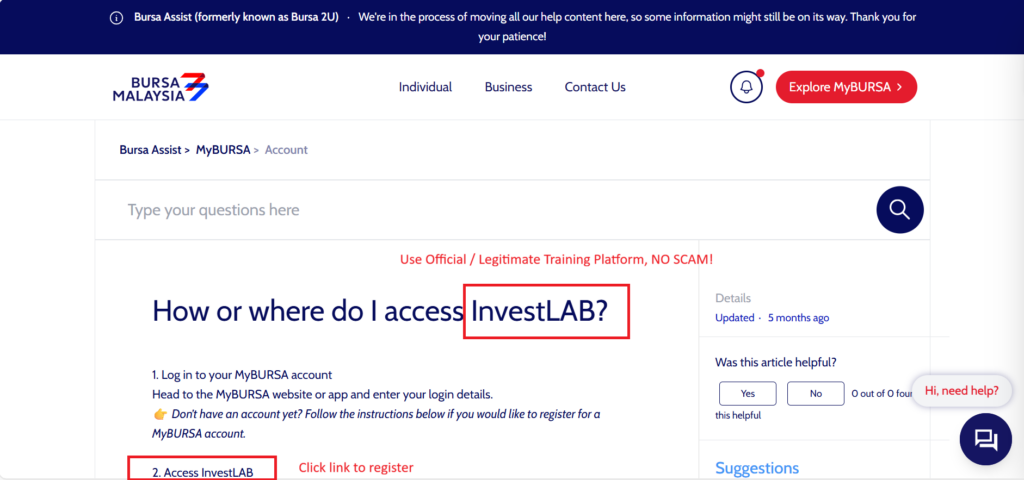

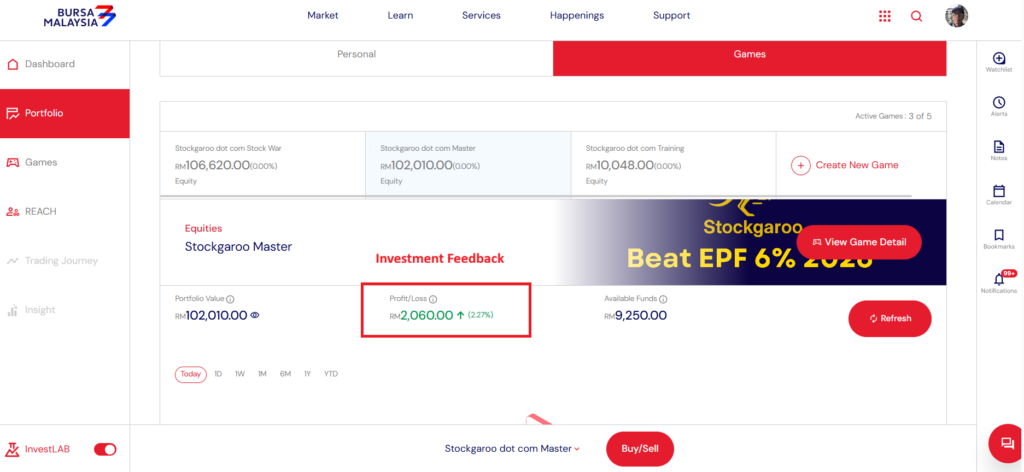

InvestLAB

Train with virtual money, real prices and market

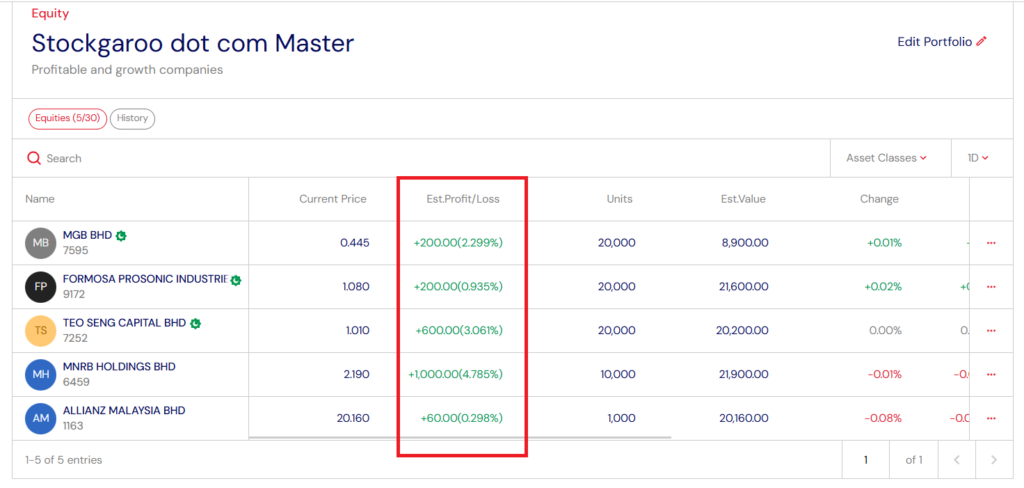

Track Record

Validate your performance

Your Next Move

| ✅ Positive Portfolio (Yes) | ❌ Negative Portfolio (No) |

|---|---|

| 1. Start investing 2. Open an account (Bursa Malaysia CDS & others) 3. Subscribe Stockgaroo Screener – Bursa, NYSE, SGX & ASX for just $0.55/day (weekly updates) – Find undervalued stocks in seconds (you know what to do) 4. Build your portfolio (5 – 20 stocks) | 💡Tips: Use the Screener to look for stock that: – Consensus: FV*** – Overall Rating: min. score greater than 70 – Financial Position: min. score greater than 70 – Cashflow: +OCF & +FCF Keep trying till you get positive portfolio. |